Federal Income Tax Irs Tax Tables 2019

Keep in mind that these same federal income tax tables can be found inside the form 1040 instructions and form 1040 sr instructions.

Federal income tax irs tax tables 2019. The amount shown where the taxable income line and filing status column meet is 2651. The tax rate increases progressively the more you earn and is divided into income tax brackets. 1038 available at irsgovirb 2018 51irbnot 2018 92 provides that until april 30 2019 an employee who has a reduction. This booklet only contains tax and earned income credit tables from the instructions for forms 1040 and 1040 sr.

The federal income tax table brackets change annually. It s fast simple and secure. 2019 2020 deduction new tax windows home improvements are a popular way for taxpayers to claim a tax credit and upgrade their homes in the process. This is the tax amount they should enter in the entry space on form 1040 line 12a.

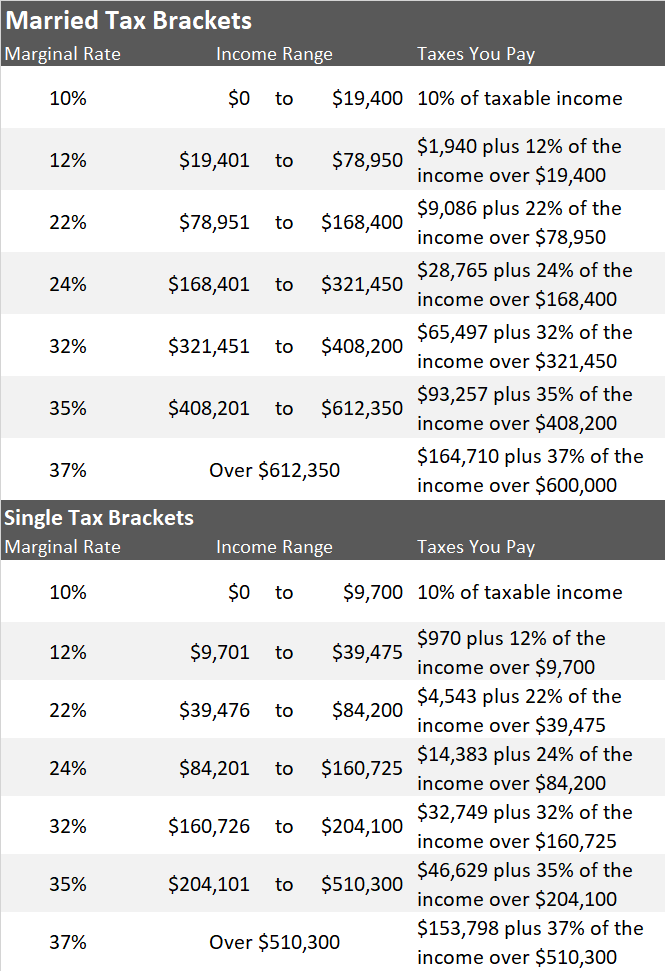

Federal income tax table changes. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. Instructions booklet 1040tt does not contain any income tax forms. Federal income tax rates are determined by your filing status and your taxable income for the year your adjusted gross income minus either your standard deduction or allowed itemized deductions.

The revenue procedure has a table providing maximum credit amounts for other categories income thresholds and phase outs. 2019 federal income tax withholding. Freefile is the fast safe and free way to prepare and e le your taxes. So what are the 2020 income tax withholding tables like without allowances.

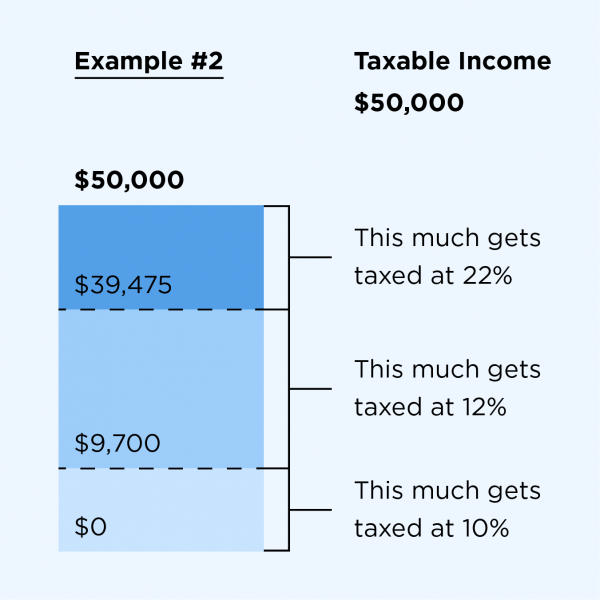

In addition to these regular amount variances the irs made significant changes to the tables themselves. This publication includes the 2019 percentage method tables and wage bracket ta bles for income tax withholding. There are seven tax rates ranging from 10 to 37 as of 2020. First they find the 2530025350 taxable income line.

Next they find the column for married filing jointly and read down the column. Tax deductions energy tax credits tags. 2019 income tax brackets and rates. View 2019 and 2020 irs income tax brackets for single married and head of household filings.

This booklet does not contain any tax forms department f ohe trteasury ntiernal evr enue service wwwrisgov 104. Notice 2018 92 2018 51 irb. The top marginal income tax rate of 396 percent will hit taxpayers with taxable income of 418400 and higher for single filers and 470700 and higher for married couples filing jointly.