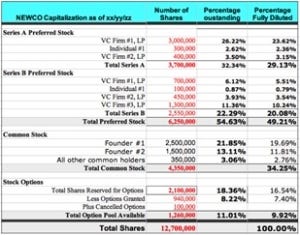

Capitalization Table

The term is often used in reference to those who hold.

/spreadsheet-1000265234-8df6c3b545ef44379518ca18e9ae03bc.jpg)

Capitalization table. Capitalization table is a record of all the shareholders of the company as well as the records of all the securities issued by the company with pricing ie preferred shares equity shares share warrants convertible debts etc. Shareholder equity refers to assets minus liabilities. The odds of being funded the odds of commercial success traits they look for good vs bad pitches and how to increase your chances of getting startup capital from a venture capital firm. Thinking of capitalization tables in terms of stock is like thinking of disney world in terms of the teacup ride.

In its simplest form a capitalization table or cap table as it is often abbreviated is a ledger that tracks the equity ownership of a companys shareholders. The startups guide to cap table management share this article. Ein cap table eigentlich capitalization table ist eine tabellarische aufstellung ueber die besitzverhaeltnisse im unternehmen. Basically it helps keep track of all the important information related all of its.

A capitalization table is most commonly utilized for startups and. A capitalization table or cap table is a table providing an analysis of a companys percentages of ownership equity dilution and value of equity in each round of investment by founders investors and other owners. Capitalization tables manage equity. Wem gehoert was und wer hat anspruch worauf.

Fuer sehr viele startups scheint das am anfang ohnehin allzu klar. Dictcc uebersetzungen fuer capitalization table im englisch deutsch woerterbuch mit echten sprachaufnahmen illustrationen beugungsformen. And their holdings which helps to keep track of equity ownership of the company and the percentage holdings of stakeholders. A cap table also called capitalization table is a spreadsheet for a startup how vcs look at startups and founders a guide to how vcs look at startups and founders.

The odds of being funded the odds of commercial success traits they look for good vs bad pitches and how to increase your chances of getting startup capital from a venture capital firm. Because virtually any company that turns out to be worth something will naturally progress into a fairly complex capitalization structure. A capitalization table or also known and often abbreviated as the cap table is a table or ledger providing an analysis of a companys or organizations percentages of ownership equity dilution and value of equity in each round of investment by the founders investors and other owners or shareholders. Company or early stage venture that.

Sure thats part of it. This capitalization table cap table template is a helpful tool for a startup how vcs look at startups and founders a guide to how vcs look at startups and founders. Wenn es drei gruender gibt gehoert jedem ein drittel des unternehmens und der gewinn wird gleichmaessig auf alle. But to understand the full scope of what capitalization tables do the operative word is equity.