2020 Federal Tax Tables Irs

Go to irs.

/how-to-fill-out-form-w-4-0947bf269e304790a4a4e818b097522f.png)

2020 federal tax tables irs. If youre a single filer in the 22 percent tax bracket for 2019 you dont pay 22 percent on all your taxable income. The percentage method and wage bracket method withholding tables as well as the. More details about the tax withholding estimator and the new 2020 withholding tables can be found on the frequently asked question pages. The irs publication 15 includes the tax withholding tables.

There are seven 7 tax rates in 2020. Publication 15 t 2020 federal income tax withholding methods. 51 agricultural employer. It s fast simple and secure.

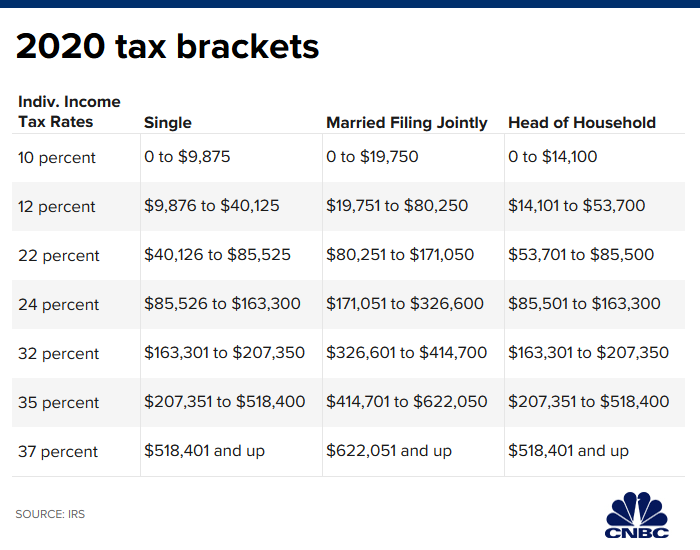

You pay 10 percent on taxable income up to 9700 12 percent on the amount from 9701 to 39475 and 22 percent above that up to 84200. 10 12 22 24 32 35 and 37 there is also a zero. To check out the new irs withholding estimator click here. The tax withholding estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your employer.

Publication 15 introductory material. Publication 15 2020 circular e employers tax guide. 15 employers tax guide and pub. For the latest information about developments related to pub.

Below are early release copies of percentage method tables for automated payroll systems that will appear in publication 15 t federal income tax withholding methods for use in 2020. Freefile is the fast safe and free way to prepare and e le your taxes. For the latest information about developments related to pub. For use in 2020.

Importantly your highest tax bracket doesnt reflect how much you pay in federal income taxes. Brackets for 2020 tax year. Publication 15 t introductory material. This publication supplements pub.

15 t such as legislation enacted after it was published go to irsgovpub15t. 24327a 2 0 1 9 tax year tax and earned income credit tables this booklet only contains tax and earned income credit tables from the instructions for forms 1040 and 1040 sr. For use in 2020. This includes the tax rate tables many deduction limits and exemption amounts.

Publication 15 t will be posted on irsgov in december 2019 as will publication 15 employers tax guide. The irs announces new tax numbers for 2020. Jan 22 2020 cat. Instead you will need to look for the publication 15 t.

Each year the irs updates the existing tax code numbers for items which are indexed for inflation. From 2020 and beyond the internal revenue service will not release federal withholding tables publication 15. The 2020 federal income tax brackets on ordinary income. 15 such as legislation enacted after it was published go to irsgovpub15.

The internal revenue service released the federal withholding tables to help employers figure out how much tax to withhold from the employers paycheck.

:max_bytes(150000):strip_icc()/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)