Eic Tax Table 2020

3584 with one qualifying child.

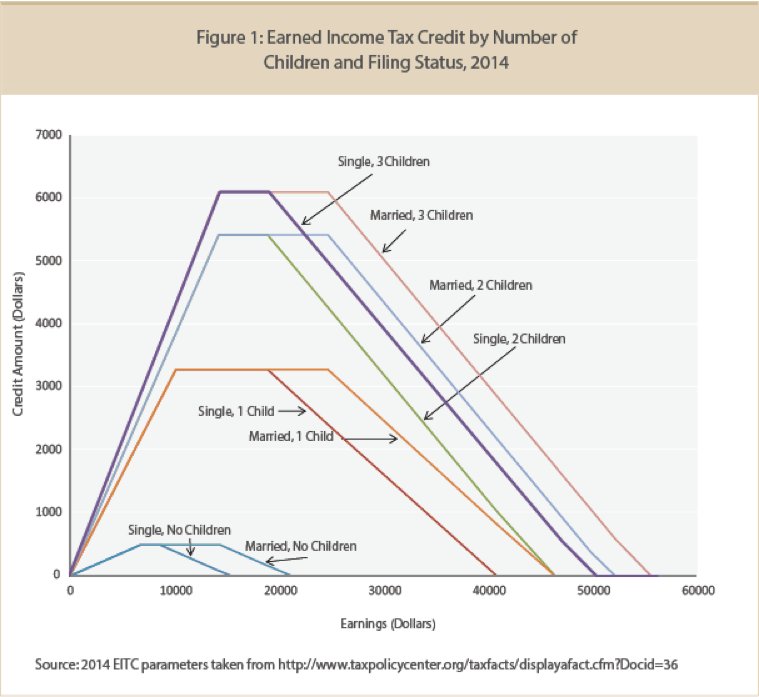

Eic tax table 2020. Earned income credit in a nutshell. To claim the eic you must meet certain rules. These rules are summarized in table 1. The maximum amount of credit for tax year 2020 is.

Irs announcing changes to earned income tax credit. So i thought i should provide a basic overview of what the earned income credit is including qualifications qualified children rules maximum credit amount income limits income tables. People who work and have earned income under 55952. Can i claim the eic.

538 with no qualifying children. On december 18 2015 an act entitled protecting americans from tax hikes act of 2015 also known as path act was enacted for the benefit of taxpayers and taxpayer families. The earned income tax credit eitc is one of the most significant tax credits available in the entire irs tax code. The eic may also give you a refund.

Changes to earned income credit table eitc will be announced over the summer months and into the fall of 2018. This booklet does not contain. The internal revenue service irs has announced the annual inflation adjustments for the year 2020 including tax rate schedules tax tables and cost of living adjustments. A tax credit usually means more money in your pocket.

The earned income tax credit is available to claim for the 2019 2020 tax season. The earned income tax credit eitc or eic has some changes implemented in 2018. It s fast simple and secure. See the earned income tax credit table or calculator below to see the maximum amount of the eitc allowed.

Coronavirus covid 19 tax relief. Freefile is the fast safe and free way to prepare and e le your taxes. 24327a 2 0 1 9 tax year tax and earned income credit tables this booklet only contains tax and earned income credit tables from the instructions for forms 1040 and 1040 sr. The irs people first initiative allows taxpayers until july 15 2020 to respond to income requests for earned income tax credit and wage verification.

It reduces the amount of tax you owe. It is also simultaneously one of the most complicated and popular tax credits as well. 6660 with three or more qualifying children. Here is the most current eic earned income credit table.

The credit has increased for joint filing taxpayers with three or more qualifying children. You will not be eligible if you earned over 5488400 or if you had investment income that exceeded 310000. Jan 22 2020 cat. The calculation of the earned income amount has not changed much.