Earned Income Credit 2020 Table

Department of the treasury internal revenue service publication 596 cat.

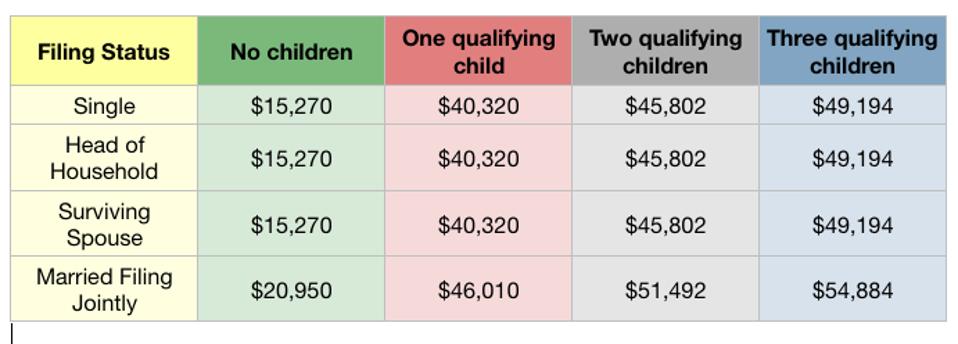

Earned income credit 2020 table. The credit maxes out at 3 or more dependents. You will not be eligible if you earned over 5488400 or if you had investment income that exceeded 310000. Examples of income that qualifies for the earned income credit includes. Earned income tax credit eitc.

15173a earned income credit eic for use in preparing 2019 returns get forms and other information faster and easier at. Eitc reduces the amount of tax you owe and may give you a refund. To qualify you must meet certain requirements and file a tax return even if you do not owe any tax or are not required to file. 5920 with two qualifying children.

Must be removed before printing. Jan 22 2020 cat. 2018 2019 2020 chart credit earned how income much table tax although an incredible number of families currently claim this valuable tax break the irs says many more qualify for this refundable tax credit yet neglect to take advantage of it. 24327a 2 0 1 9 tax year tax and earned income credit tables this booklet only contains tax and earned income credit tables from the instructions for forms 1040 and 1040 sr.

538 with no qualifying children. Earned income credit the earned income credit is available since 1 january 2016. Page 1 of 25 913 22 jan 2020 the type and rule above prints on all proofs including departmental reproduction proofs. The earned income tax credit is available to claim for the 2019 2020 tax season.

3584 with one qualifying child. Maximum credit amounts the maximum amount of credit for tax year 2020 is. It is a separate credit to the employee tax credit in that it can also be claimed by people who are self employed. 6660 with three or more qualifying children.

Earned income tax credit credit table category. Irsgov english irsgovspanish. The earned income tax credit eitc or eic is a benefit for working people with low to moderate income. Page 1 of 41 1319 28 jan 2020 the type and rule above prints on all proofs including departmental reproduction proofs.

For 2020 the maximum eitc amount available is 6660 for married taxpayers filing jointly who have three or more qualifying children its 538 for married. Must be removed before printing. It is allowed in respect of the pay that you earn. Here is the most current eic earned income credit table.

It is also simultaneously one of the most complicated and popular tax credits as well. See the eic earned income credit table amounts and how you can claim this valuable tax credit.

/cdn.vox-cdn.com/uploads/chorus_image/image/65385272/838281776.jpg.0.jpg)