1040ez Tax Table 2020

This booklet does not contain.

1040ez tax table 2020. Below are early release copies of percentage method tables for automated payroll systems that will appear in publication 15 t federal income tax withholding methods for use in 2020. It s fast simple and secure. 2017 2020 form irs 1040 tax table fill online printable fillable 2017 form irs instruction 1040 ez fill online printable fillable 2019 1040ez form and instructions 1040 ez easy 3 11 individual income tax returns internal revenue service. Freefile is the fast safe and free way to prepare and e le your taxes.

Please note this calculator is for tax year 2019 which is due in 2020. For tax year 2018 and later you will no longer use form 1040 ez but instead use the form 1040 or form 1040 sr. Please note this calculator is for tax year 2020 which is due in 2021. They are not the numbers and tables that youll use to prepare your 2019 tax returns in 2020 youll find them here.

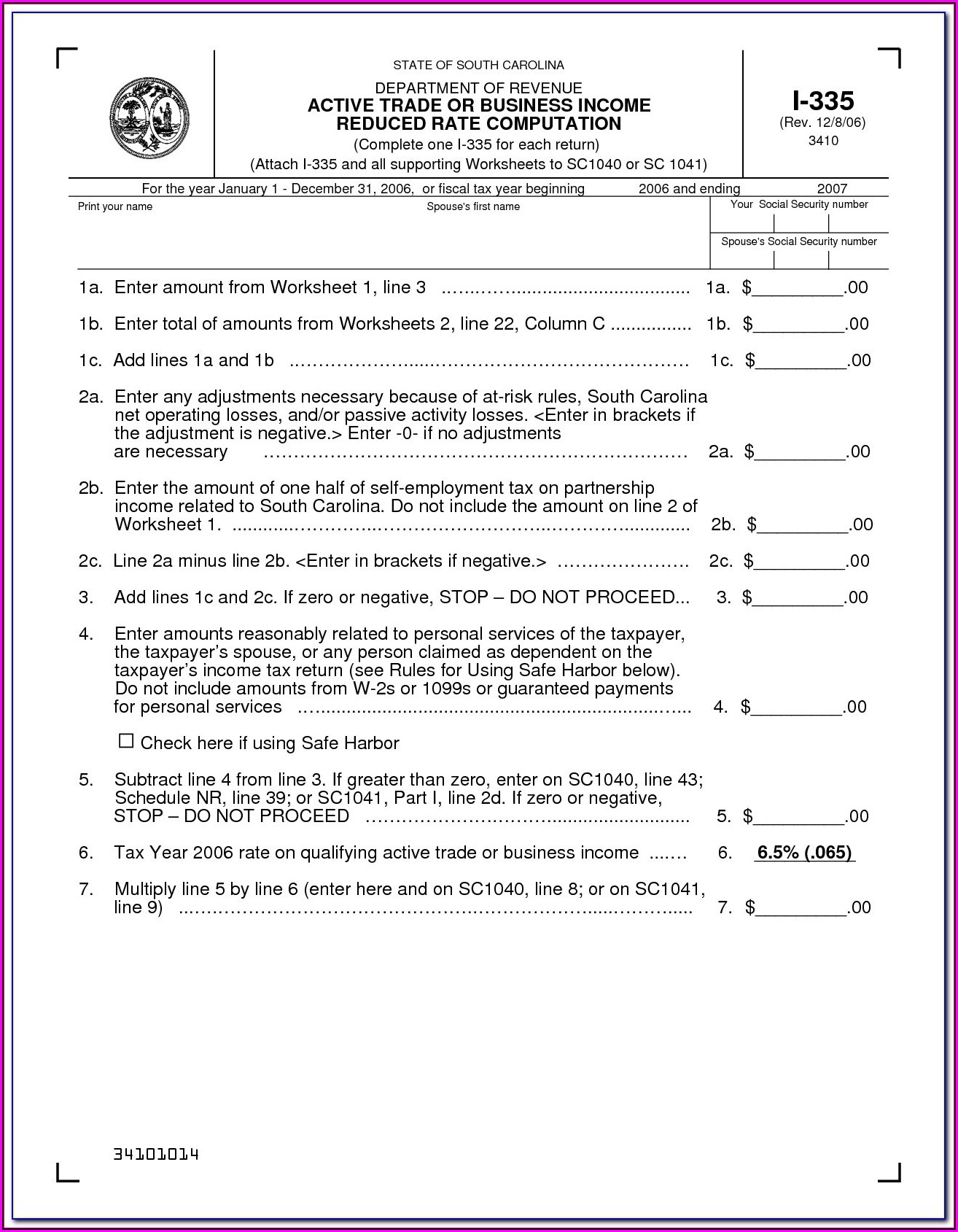

51 agricultural employers tax guide. 15 employers tax guide and pub. Then enter the tax from the table. Publication 15 t will be posted on irsgov in december 2019 as will publication 15 employers tax guide.

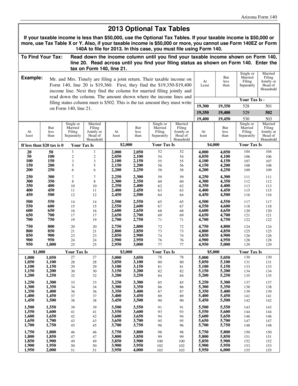

Irs gov 1040ez tax table 2017. Use the filing status and income tax rates table to assist you in estimating your. On line 11 you should indicate whether you had full year health coverage. This is your total tax.

If not you will have to enter an individual responsibility payment. For line 10 use the amount on line 6 to find your tax in the tax table in the form instructions. Based on your projected tax withholding for the year we then show you your refund or the amount you may owe the irs next april. These are the numbers for the tax year 2020 beginning january 1 2020.

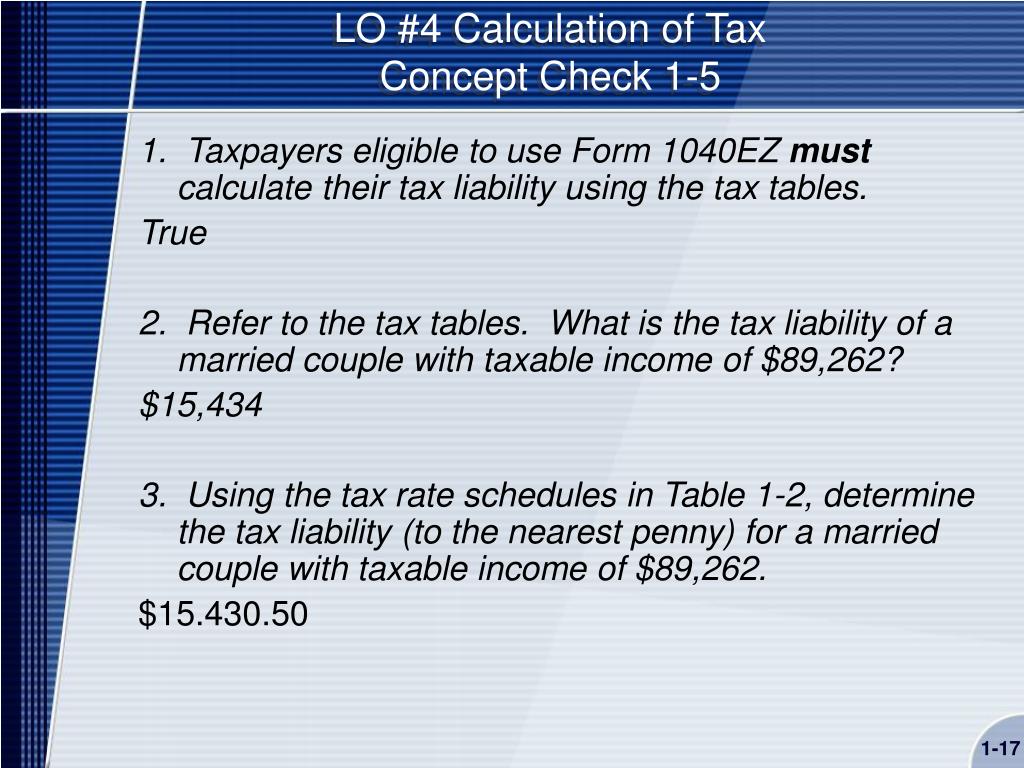

If filing the 1040ez after you calculate your taxable income you can use the tax table found at the end of the form 1040ez instructions to calculated how much tax you owe. It describes how to figure withholding using the wage bracket method or percentage method describes the alternative methods for figuring withholding and provides the tables for withholding on distributions of indian gaming profits to tribal members. For line 12 add lines 10 and 11. The 1040ez is a simplified form used by the irs for income taxpayers that do not.

The irs instructions for the form 1040ez includes a tax table that can be used to calculate your tax liability for the year. This publication supplements pub. We also offer 1040 ez calculators for tax years 2017 2018 2019. Whats people lookup in this blog.